Reports

Markets

Latest

Maps

Learn

Chat

Reports

Markets

Latest

Maps

Learn

Chat

Sales were up 2% in 2025, and we forecast sales to rise by 3% in 2026 driven by an interest rate forecast of 6.2%.

We expect rates to average 6.2% and sales to grow by 3%.

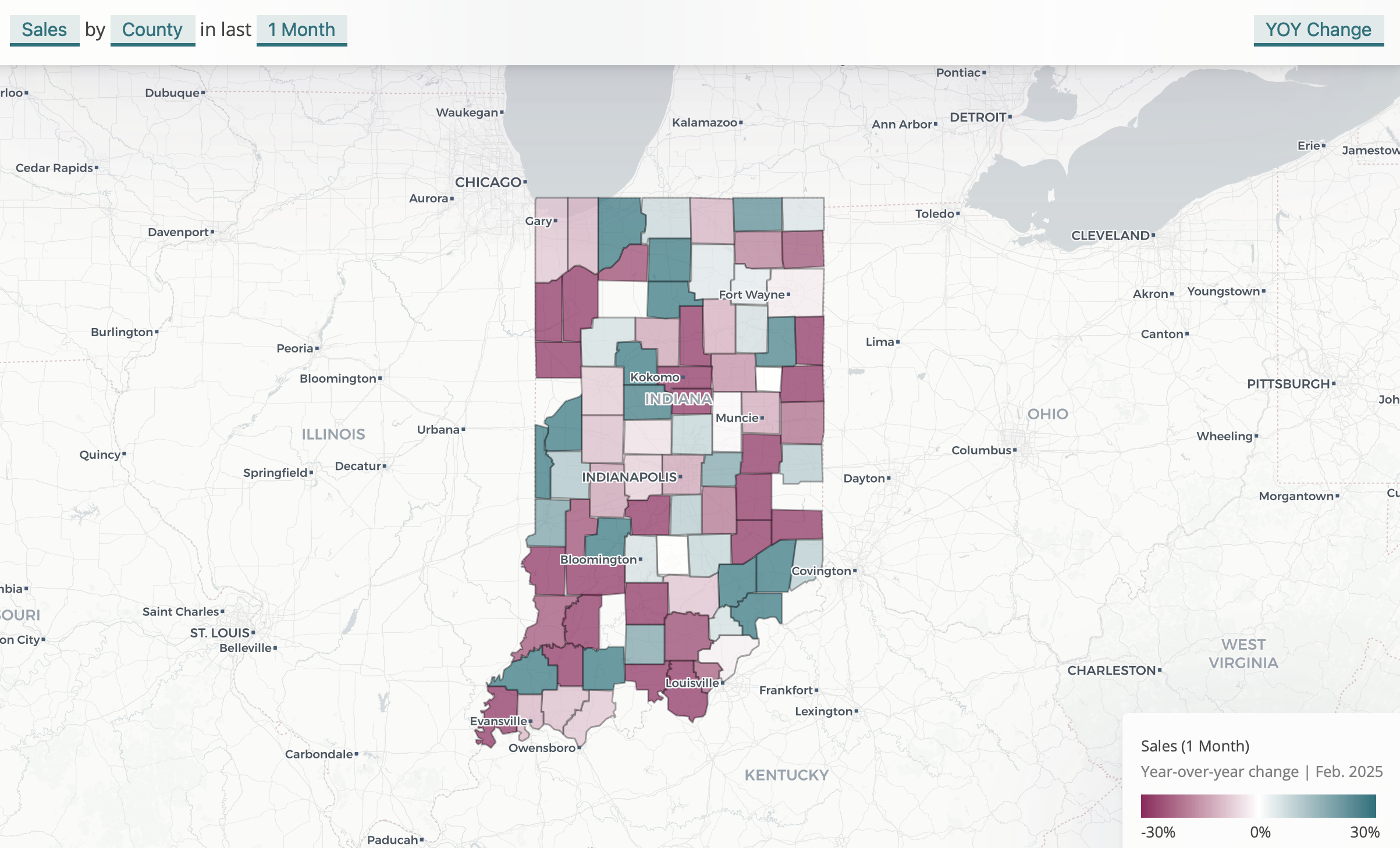

Suburban sales held up better than statewide sales last month. That was driven by three large and high-performing counties: Hendricks, Johnson, and Hamilton.

Suburban sales held up better than statewide sales last month. That was driven by three large and high-performing counties: Hendricks, Johnson, and Hamilton.

What does our market data tell us about price trends in 2025, and what insights can Indiana REALTORS® share with clients and partners about the outlook for home values?

Sales growth diverges widely over the past three weeks in Indiana's largest cities.

Sales growth diverges widely over the past three weeks in Indiana's largest cities.

Days on market can vary dramatically even within the same city—this week’s map of Indianapolis shows how some ZIP codes move fast while others take much longer to sell.

Days on market can vary dramatically even within the same city—this week’s map of Indianapolis shows how some ZIP codes move fast while others take much longer to sell.

This Monday's map dives into sales by ZIP Code for the week starting February 3.

This Monday's map dives into sales by ZIP Code for the week starting February 3.

This week, we take a look at listings by ZIP Code through the first month of the year.

This week, we take a look at listings by ZIP Code through the first month of the year.

Homes that went under contract in the week of January 20 had been on the market an average of 38 days. The trendline is headed up, whereas last year at this time the pace of home sales was quickening. In 52 counties, homes are taking longer to sell compared to the same week last year.

Homes that went under contract in the week of January 20 had been on the market an average of 38 days. The trendline is headed up, whereas last year at this time the pace of home sales was quickening. In 52 counties, homes are taking longer to sell compared to the same week last year.

Listings are climbing year-over-year in most of Indiana's large cities.

Listings are climbing year-over-year in most of Indiana's large cities.

While new purchase agreements activity is slower than last January's hot start, a few cities are beating there year-over-year pending numbers.

While new purchase agreements activity is slower than last January's hot start, a few cities are beating there year-over-year pending numbers.

Indiana's urban centers had a strong first of week sales in the new year. Today's Monday Map is focused on year-over-year sales trends for the week beginning Dec. 30.

Indiana's urban centers had a strong first of week sales in the new year. Today's Monday Map is focused on year-over-year sales trends for the week beginning Dec. 30.