Reports

Markets

Latest

Maps

Learn

Chat

Reports

Markets

Latest

Maps

Learn

Chat

Sales were up 2% in 2025, and we forecast sales to rise by 3% in 2026 driven by an interest rate forecast of 6.2%.

We expect rates to average 6.2% and sales to grow by 3%.

2024 finished with 78,400 sales, 300 more than last year, as elevated rates kept many homeowners locked in to their current mortgage. Still, listings grew by 3%, sales volume grew by 7%, and there was momentum to finish the year—sales were up 2.6% year-over-year in the last two quarters.

2024 finished with 78,400 sales, 300 more than last year, as elevated rates kept many homeowners locked in to their current mortgage. Still, listings grew by 3%, sales volume grew by 7%, and there was momentum to finish the year—sales were up 2.6% year-over-year in the last two quarters.

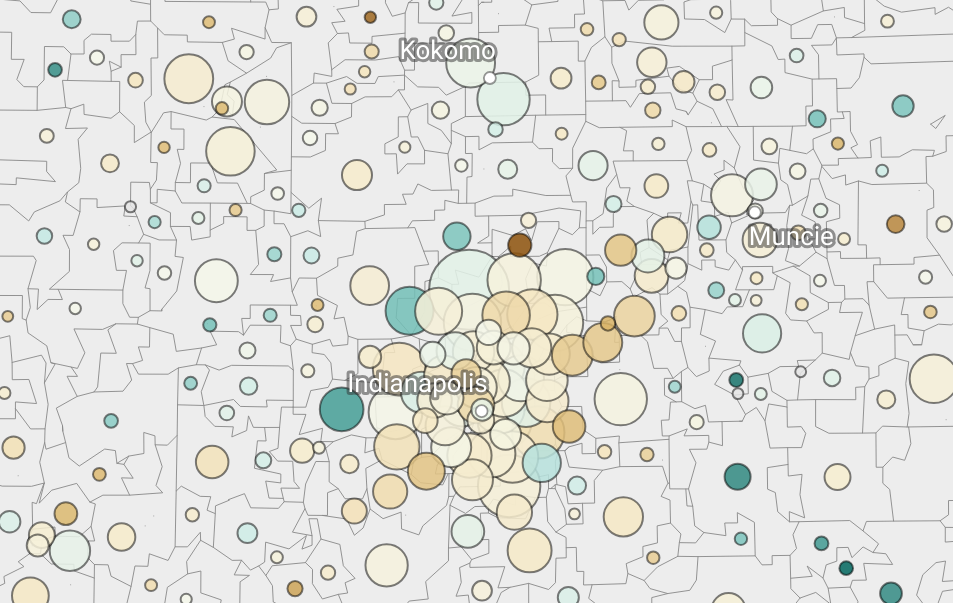

In a new weekly feature, we look at days on market by county in our latest weekly data.

In a new weekly feature, we look at days on market by county in our latest weekly data.

Statewide median sale price grew by 4% year-over-year in the third quarter, but most metro areas in the state experienced price growth that was significantly faster or slower than the average.

We analyzed 12 months of sales from September 2023 to August 2024 to see if homes were under contract faster when listing prices were closer to the sale price. When the listing price was on target, 75% of homes sold in 14 days. Listings that have to come down in by price by even 5% can stay on the market for weeks.

While sales in the last 12 months are down 7% year-over-year, one-in-four high-volume ZIP Codes are beating that trend with positive sales growth.

While sales in the last 12 months are down 7% year-over-year, one-in-four high-volume ZIP Codes are beating that trend with positive sales growth.

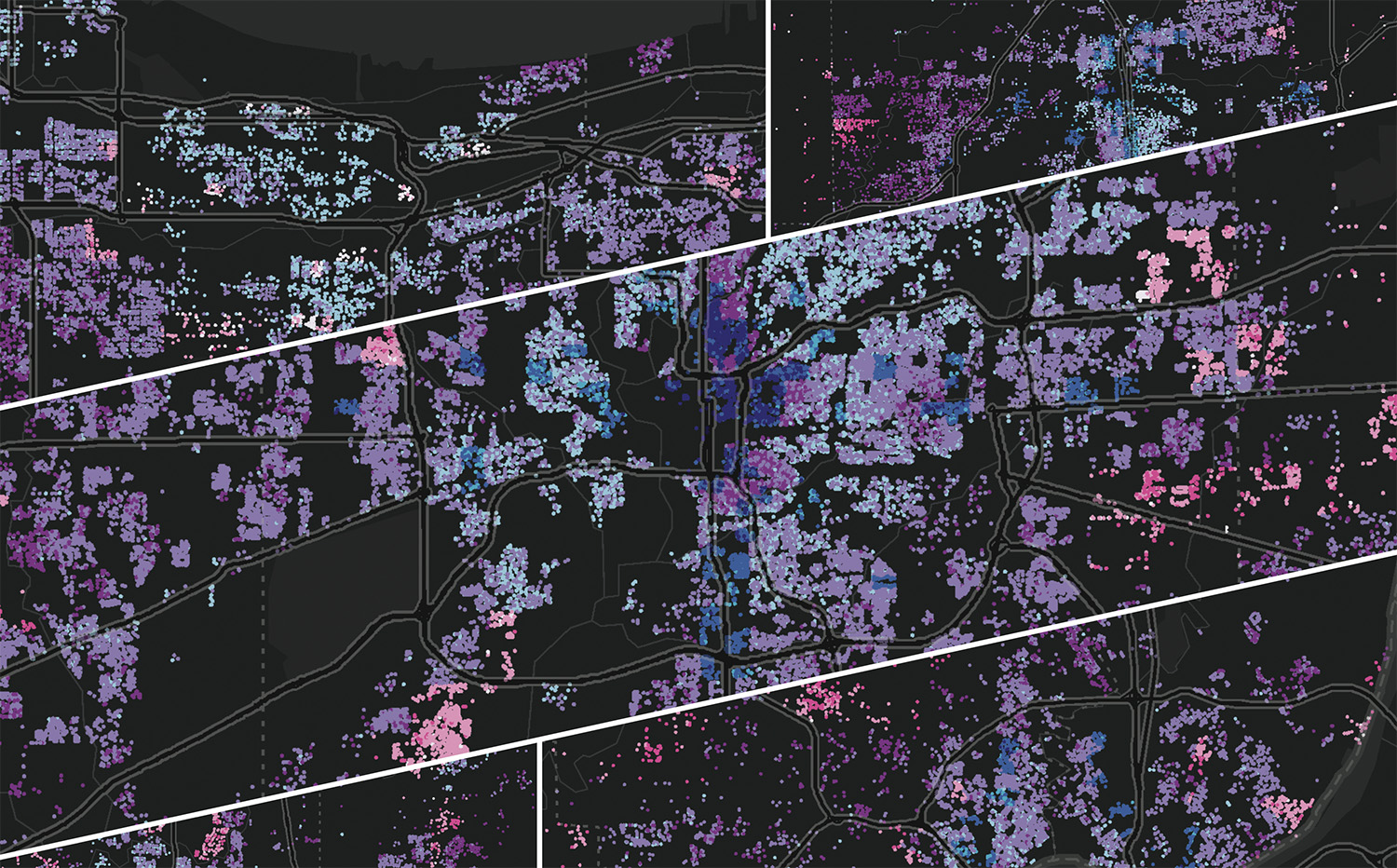

In larger cities across Indiana, older homes in neighborhoods near downtowns have experienced significant increases in sale price and volume over the past five years – leading a trend of rising home values and an overall price premium for walkable neighborhoods in urbanized counties.

Four out of five Hoosier households live in a metropolitan area. We explore market trends using the latest April 2024 data.