Reports

Markets

Latest

Maps

Learn

Chat

Reports

Markets

Latest

Maps

Learn

Chat

In larger cities across Indiana, older homes in neighborhoods near downtown business districts have experienced significant increases in sale price and volume over the past five years – leading a trend of rising property values and an overall price premium for walkable neighborhoods in urbanized counties.

This analysis suggests growing homebuyer demand for walkability as well as affordable housing options close to employment centers; it also highlights the redevelopment potential of historic urban neighborhoods and opportunities for residential density and in-fill development as communities consider future housing needs.

A historic neighborhood in Fort Wayne, Indiana.

Indiana’s housing shortage is a business reality to Hoosier REALTORS®. Since 2014, the state’s inventory of homes for sale on Multiple Listing Services has declined more than 70%, from 38,000 listings available on an average day to fewer than 11,000 today (May 2024). A number of factors have contributed to this dramatic slide in active listings—for example, slowing migration rates, owners staying in their homes longer on average, including a growing senior population aging in place.

Housing development has also fallen behind demographic demand. Since 2014, Indiana has grown by more than 160,000 new households while adding fewer than 120,000 net housing units. Residential permits (as a rolling monthly average) remain more than 30% below their mid-2000s level; on a per-household basis, homebuilding activity lags at a thirty-year low. This leaves Indiana with a deficit of at least 30,000 housing units, according to a 2023 study conducted on behalf of the Indiana Association of REALTORS® by Fourth Economy Consulting (“Indiana Housing Development Finance and Promising National Practices”).

But Indiana’s housing supply challenges can’t just be summed up as a straightforward statewide deficit.

The location and types of housing inventory has to meet population trends and consumer preferences, as well as practical considerations like proximity to employment centers, development costs, infrastructure and other factors.

National surveys also show homeowners and homebuyers increasingly prioritizing walkability, trading lot size for convenient access to daily necessities, shopping, recreation and cultural amenities, even paying higher prices to live in these areas.

Is there increased demand for homes in walkable neighborhoods across Indiana as well? This analysis focuses on price trends for walkable housing, using price appreciation and sales volume to reflect buyer preferences.

This brief identifies a price premium for housing in walkable urban neighborhoods. Notably, the relationship between price and walkability is strongest in five counties that collectively account for less than 7% of Indiana’s land by square miles, but are home to more than 30% of both the state’s jobs and total residents.

A neighborhood on the southeast side of Indianapolis.

The results have implications for land use policies, residential development and downtown redevelopment strategies, addressing workforce housing gaps common in growing communities and untapped opportunities to upgrade and expand housing options closer to the city centers that anchor Indiana’s growing metropolitan regions.

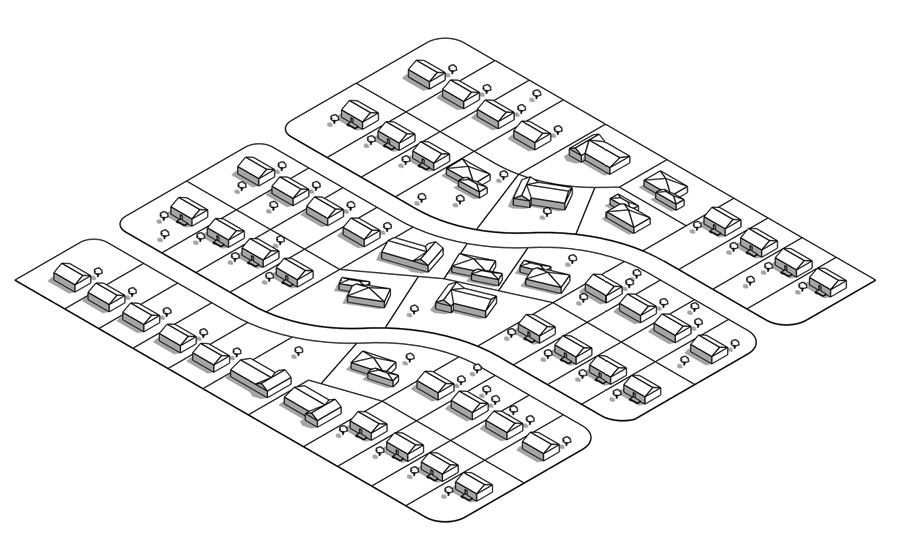

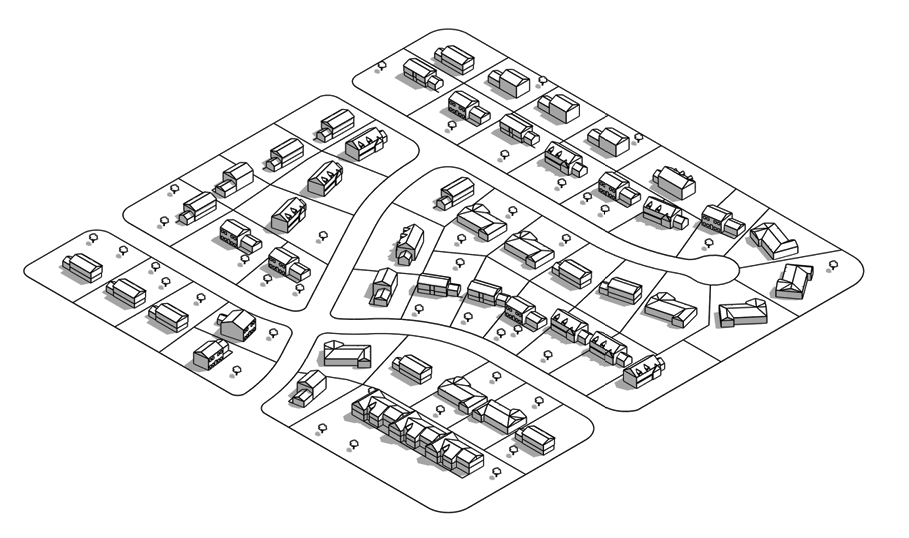

Most of Indiana’s communities, from the largest cities to the smallest towns, developed in a similar historic growth pattern. The origin of a community, often a courthouse square or an important trade location such as a river or railroad depot, developed in the 19th and early 20th century. In larger cities, dense growth extended along streetcar or interurban rail lines.

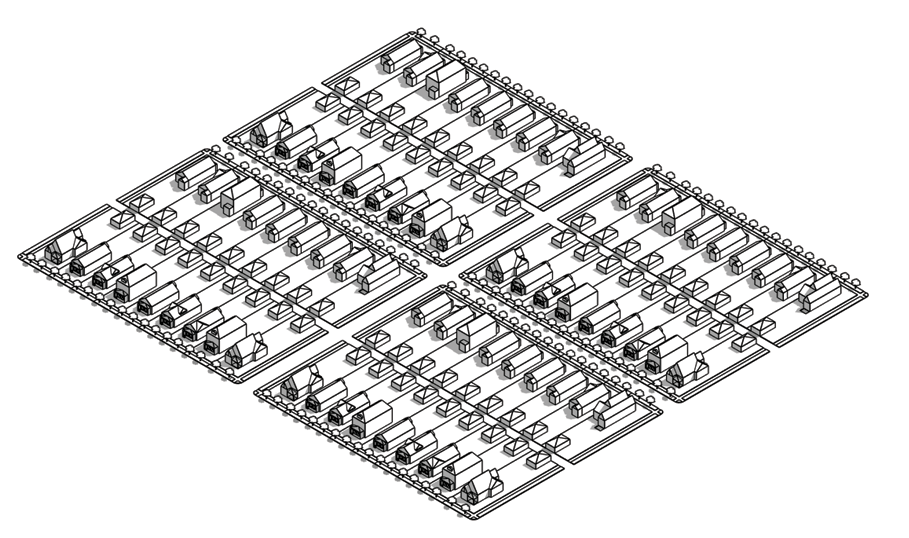

Homes built in this era are often on smaller lots, creating denser neighborhoods. Streets are laid out in tight grids and often have sidewalks; residential and commercial properties are often adjacent or in close proximity. These building patterns make older neighborhoods city-centers more walkable. Home building declined in the 1930s as the Great Depression gripped the nation. This continued in the 1940s as the War Production Board banned non-defense construction and severely limited home-building.

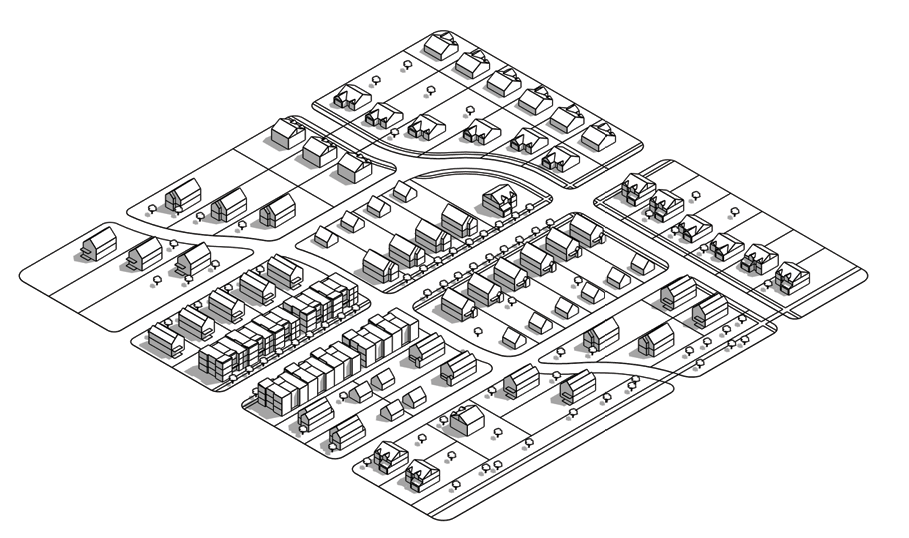

In the post-war period, pent-up demand and wider access to home financing (with the advent of the thirty-year mortgage in the 1950s) drove a building boom. New construction techniques and community planning trends led to homes and neighborhoods very different from those built before the war. Lots were larger and homes were smaller. In recent home sales, homes built before 1945 had an average lot size of 0.14 acres, but lots of homes built between 1945 and 1970 average 0.25 acres. Pre-war homes average 1,548 square, but post-war homes average 1,400 square feet.

Suburban developments at the end of the 20th century featured larger homes and larger lots, but recent sales of homes built since 2000 average larger homes on smaller lots.

Because the time during which a home was built determines so much about the density and walkability of neighborhoods, we begin our analysis by examining sales trends among pre-war homes. These make up most of the residential inventory in the most walkable urban neighborhoods. We hope to understand if homes in older, walkable neighborhoods are selling for higher prices, selling at a higher total volume, or if price or volume are growing more quickly than newer homes.

Scroll through these slides to see how housing and lot sizes have changed over time. This data is based on homes sold between 2021 and 2023.

Before 1945: Lot Size: 1/6 acre, Home Size: 1,560 square feet, 2.9 bedrooms

1945-1970: Lot Size: 1/4 acre, Home Size: 1,410 square feet, 3.0 bedrooms

1971-2000: Lot Size: 1/4 acre, Home Size: 1,740 square feet, 3.3 bedrooms

2001 and later: Lot Size: 1/5 acre, Home Size: 2,080 square feet, 3.5 bedrooms

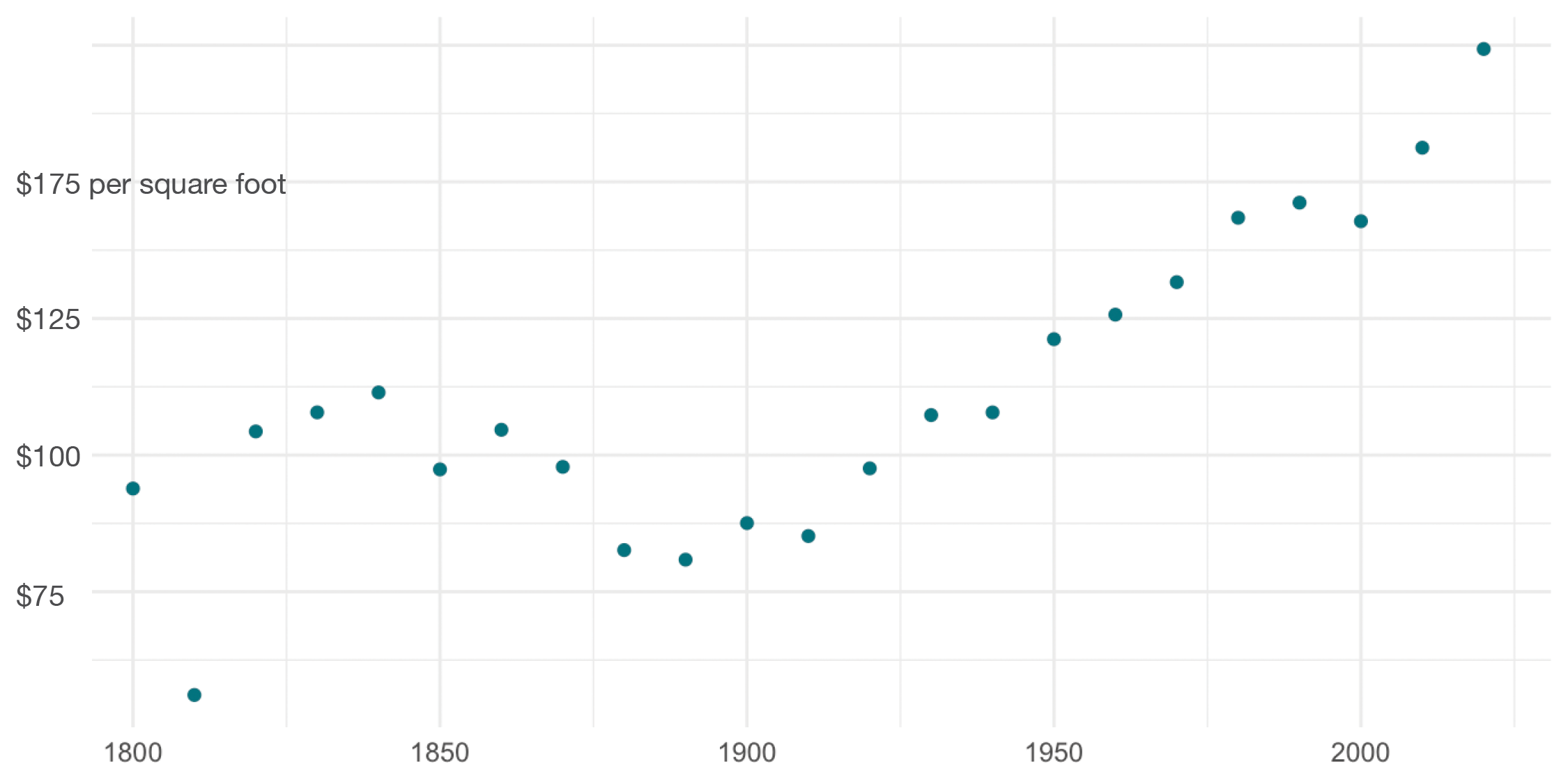

On average, older homes are selling for lower prices than newer homes. There is a price bump for the very oldest homes—those built in the middle of the 19th century—but these homes are rare. Walkable urban neighborhoods are more commonly made up of homes from the early 20th century.

Because walkable neighborhoods tend to be made up of older homes, the low relative price of pre-war homes seems to indicate low demand for walkable neighborhoods. However, this belies a few other important trends. First, though prices tend to be lower for older homes, price growth has been faster. Second, when we control for the age of the home and measure walkability directly, we do see a price premium for walkable neighborhoods.

Newer homes sell for higher price per square foot

Median sale price per square foot by decade of construction

Note: Home sales listed in MLS systems between 2021 and 2023 in urbanized counties in Indiana.

In the last five years, the median price of a home built before 1930 has grown by 80%. Homes built in the 2010s have higher prices, but their prices have grown at half that rate.

Price growth is fastest for pre-war homes

5-year change in median sale price by decade of construction

Note: Price change between sales in 2017-2018 compared to 2022-2023 in urbanized counties.

Growth in sales volume is even more pronounced for pre-war neighborhoods. Over five years, sales volume jumped 68% for homes built between 1900 and 1929. These homes accounted for $1.4 billion in sales in 2017-2018 and $2.4 billion by 2022-2023.

Sales volume grew fastest for homes built before 1930

5-year change in sales volume by decade of construction

Note: Total volume of sales in 2017-2018 compared to 2022-2023 in urbanized counties.

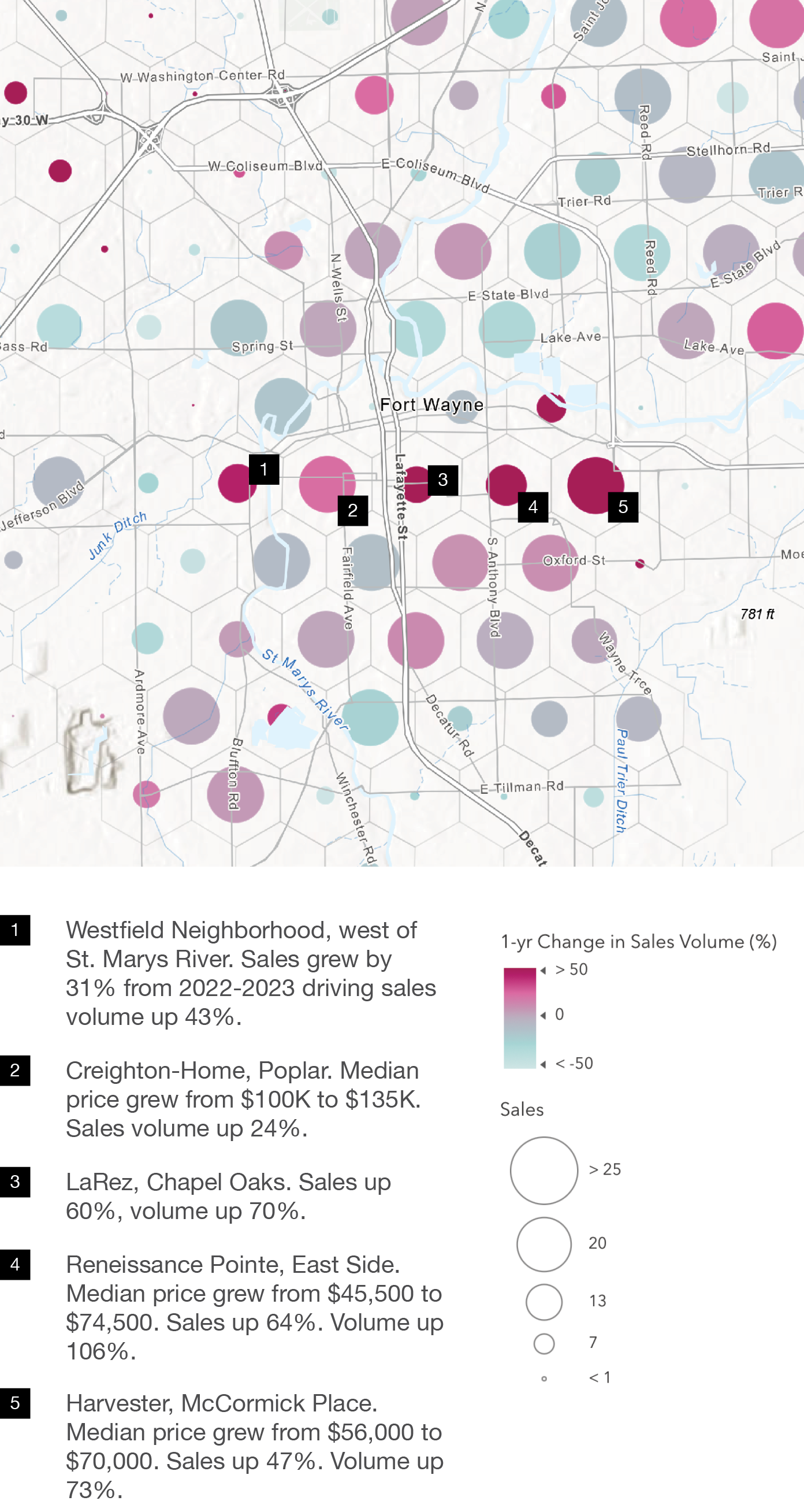

In many Hoosier cities, lower-priced neighborhoods near downtowns have experienced an uptick in sales and a dramatic increase in prices. This leads to growth in sales volume of 50% or more in areas where prices still remain relatively low.

The Fort Wayne neighborhoods with the highest growth in sales volume are low-priced areas just south of Downtown. Most homes in these areas sell for less than $100,000, but one-year price growth of 25% or more is typical in many of these neighborhoods.

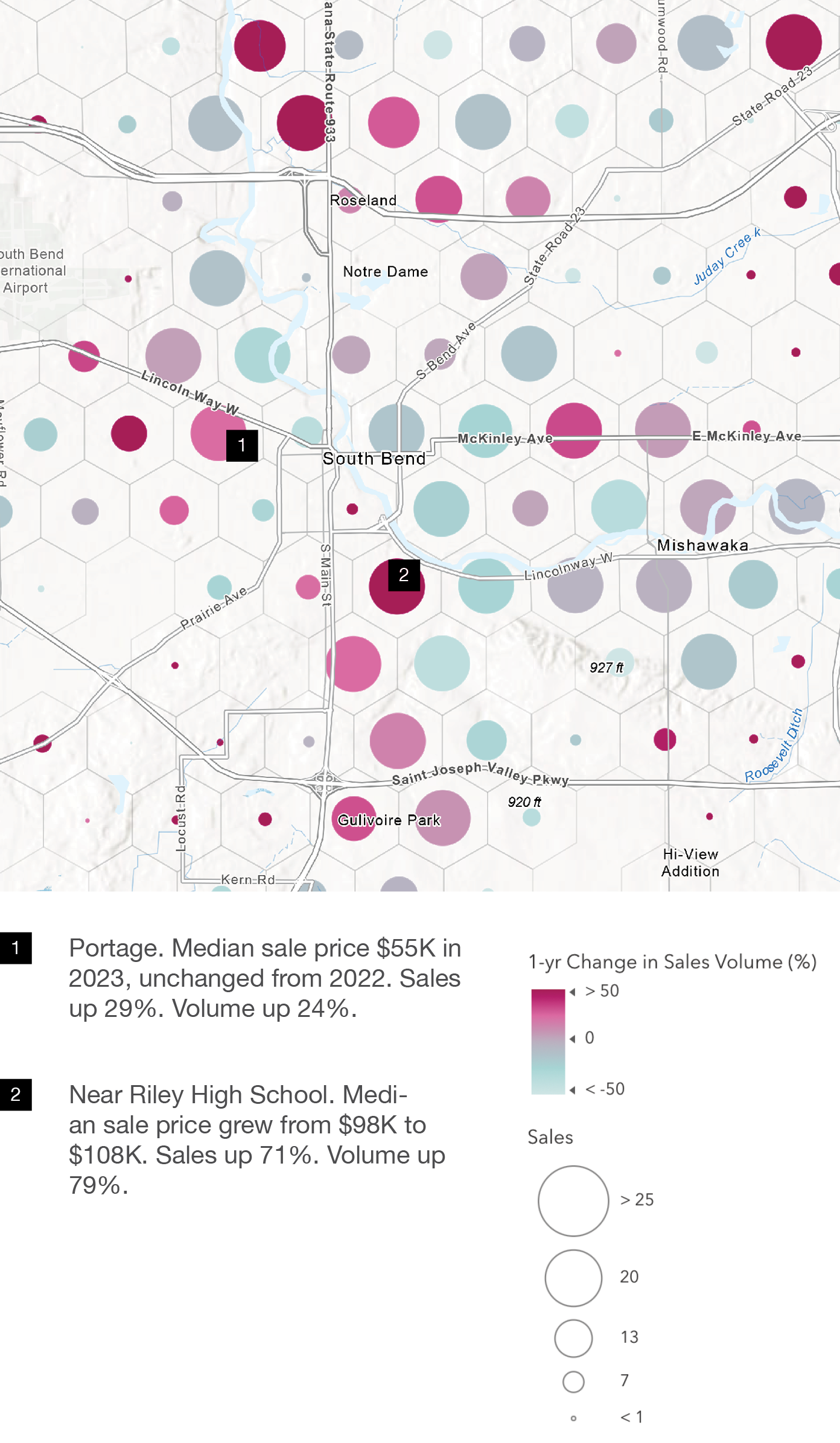

Two South Bend neighborhoods built largely between 1900 and 1930 saw strong volume growth from 2022 to 2023. Sales grew 29% in the Portage neighborhood and surrounding areas northwest of Downtown. Despite flat prices, this drove a 24% increase in volume.

The neighborhoods surrounding Riley High School experienced strong sales growth, from 12 sales in 2022 to 29 in 2023. Combined with strong price growth, this drove volume to nearly double, from $1.8 million in 2022 to $3.2 million in 2023.

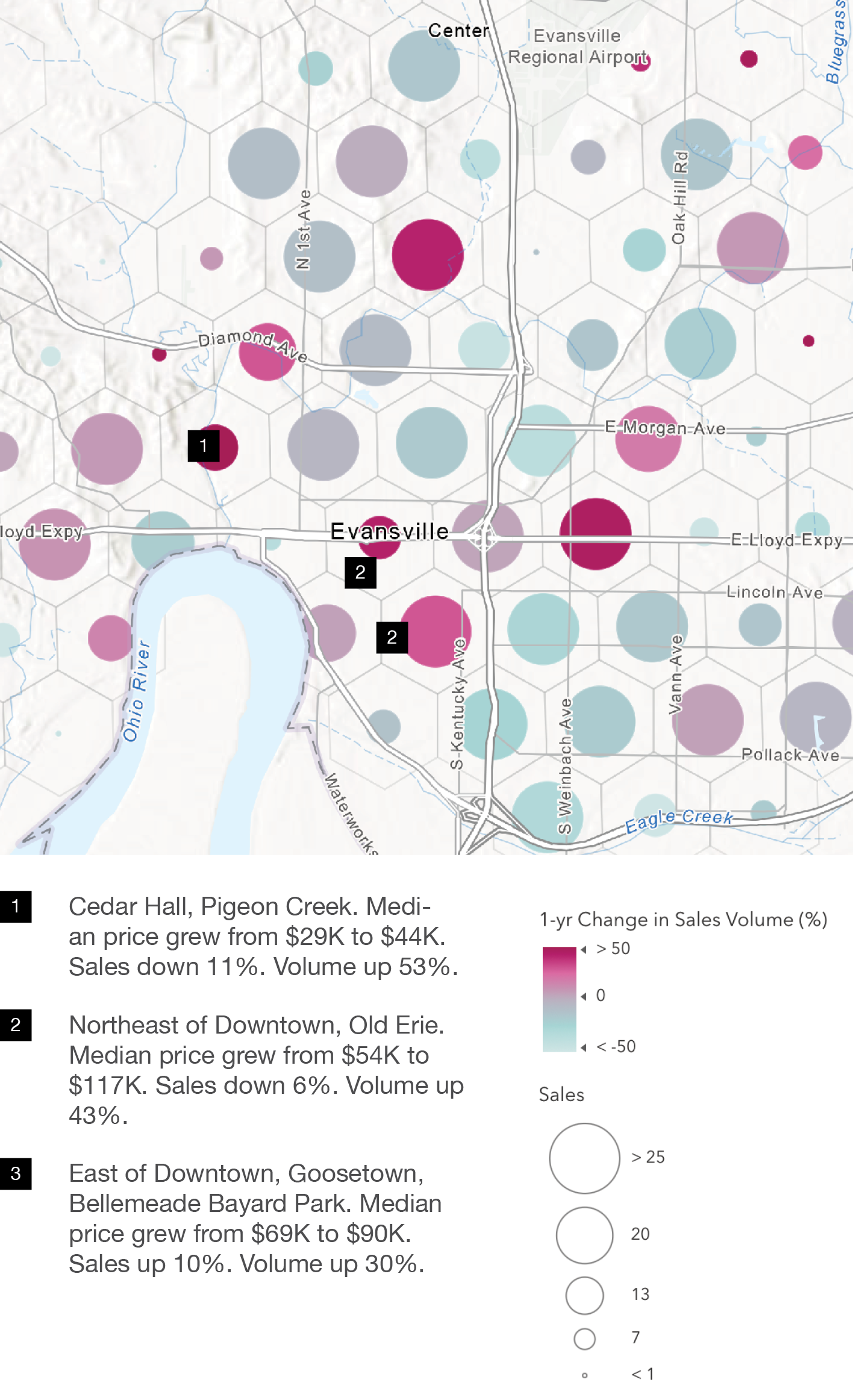

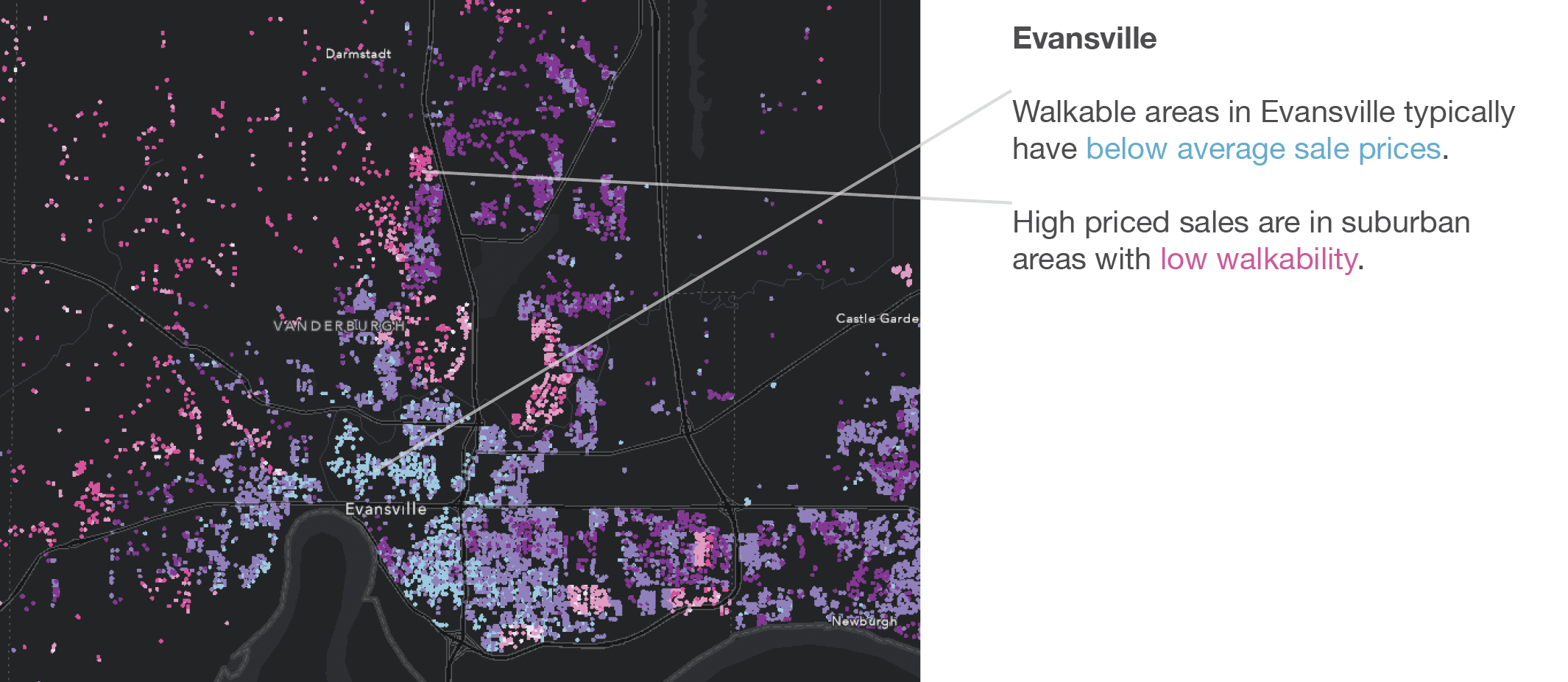

North of Downtown Evansville, Cedar Hall and Pigeon Creek are early-20th century neighborhoods that have long had very low housing prices and high vacancy rates—in 2022, the vacancy rate was 18% according to the American Community Survey, compared to 9% for Vanderburgh County overall. But prices, and therefore sales volume, grew substantially last year.

Immediately northeast of downtown, the median home sold for $117K in 2023, double the median sale price for the previous year. Despite fewer sales, price increases led to an increase in sales volume from $1.1 million to $1.6 million. The typical home sold in this area was built around 1920.

Southeast of downtown, the area containing Bellemeade Bayard Park and Goosetown experienced increased sales and rising prices (from $69K to $90K), which caused volume to rise from $5.1 million to $6.6 million.

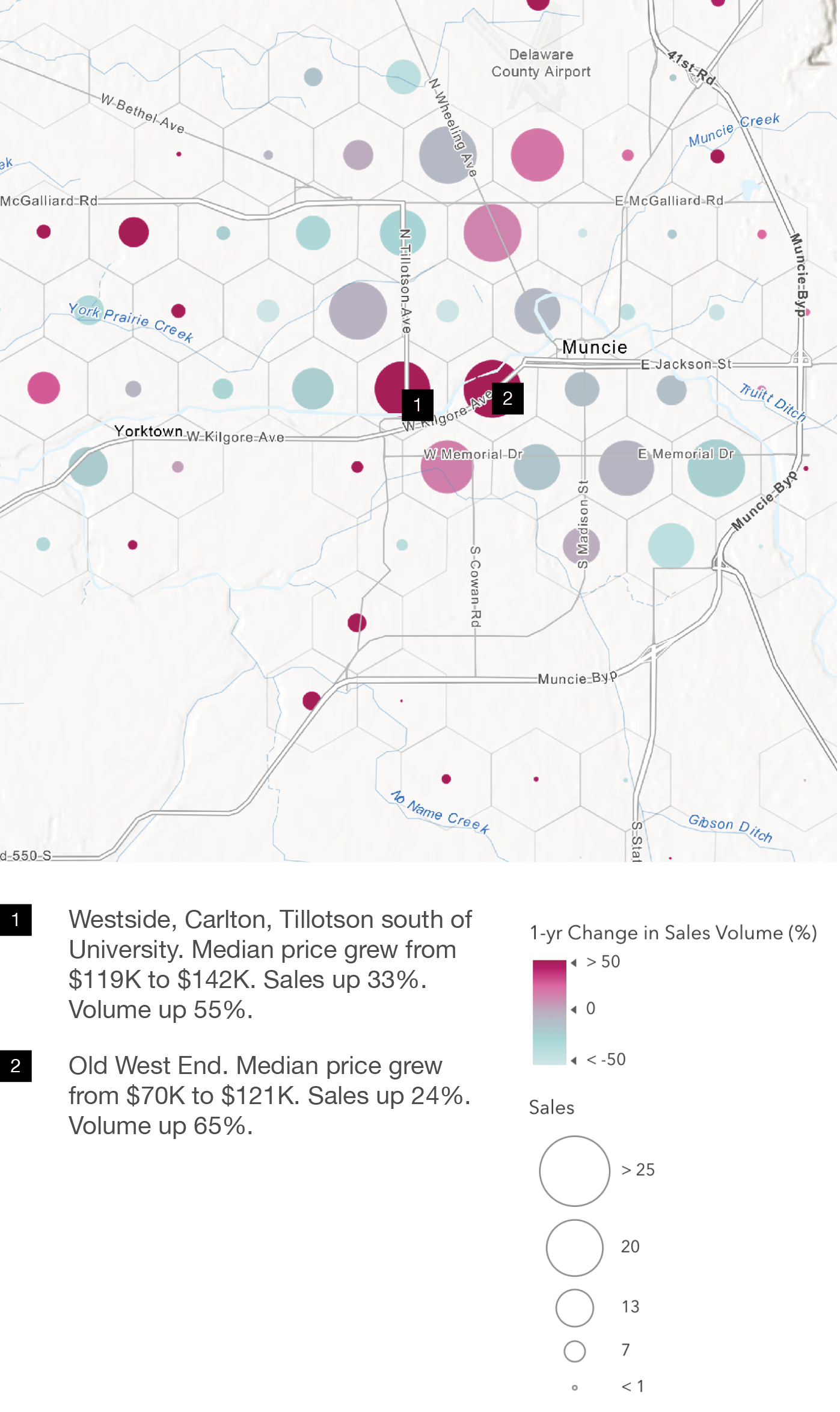

Patterns in Muncie are similar to Fort Wayne: Lower priced neighborhoods near the downtown are experiencing strong growth in sales volume. In this case, the neighborhoods with strong sales growth are just west of Downtown, inclduing the Old West End, Westside, and Carlton.

The Old West End neighborhood typifies are significant pattern—this pre-war neighborhood is dense and walkable, but has low home values driven by decades of disinvestment and flight to newer suburbs. Now a convergence of forces—increased demand for walkable neighborhoods, fewer and fewer options for affordable homes—are driving up sales and prices. Though the market is not nearly as mature as the kind of high-priced urban neighborhoods found in parts of Indianapolis, for example, the positive trend is still important.

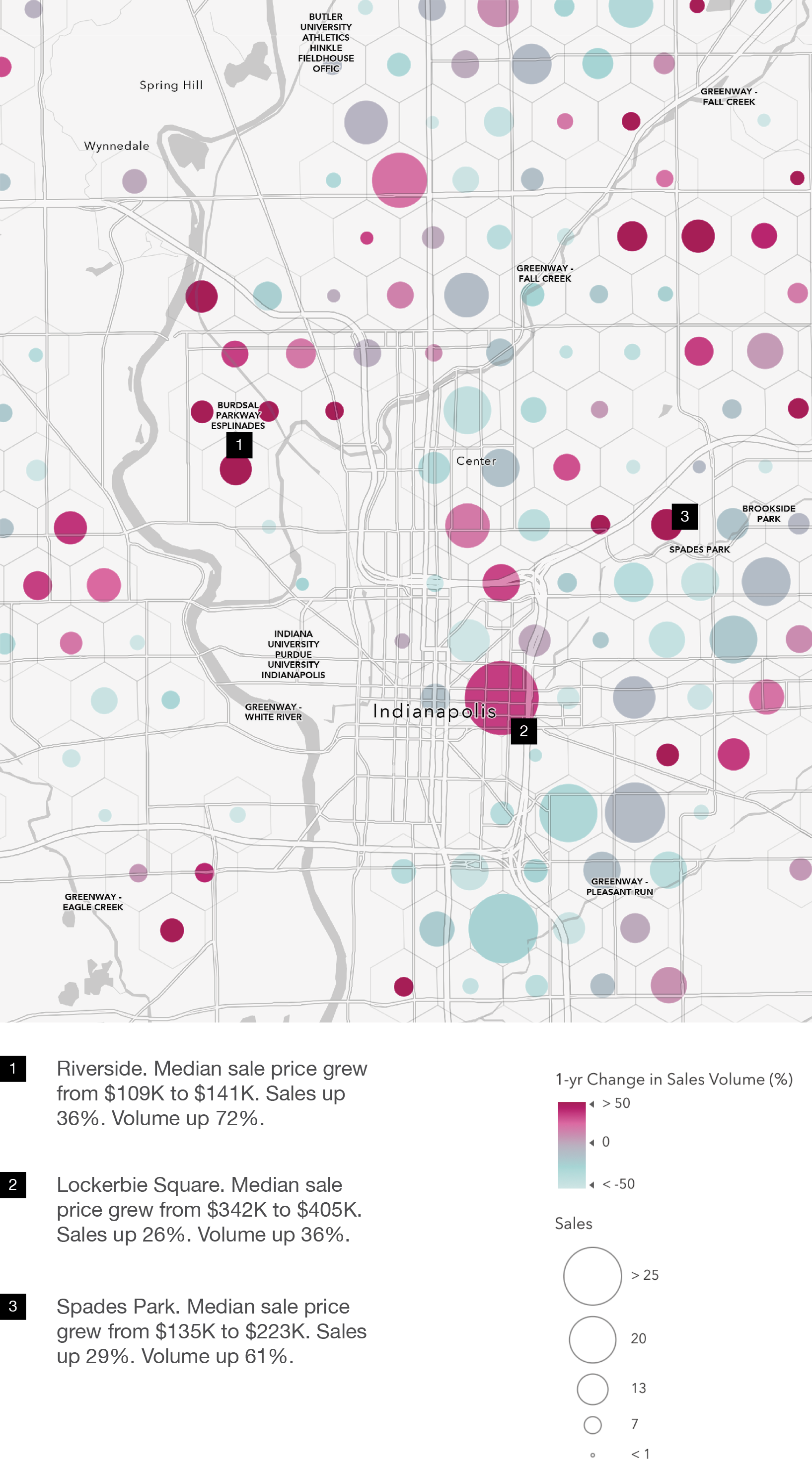

The Indianapolis market differs from the other cities shown here. After decades of redevelopment and reinvestment, many core neighborhoods have mature markets where prices are already high and dramatic growth in sales is unusual.

However, there are some examples of older, walkable neighborhoods with stand-out volume growth. We have selected three examples, each at a different position in terms of market maturity.

Riverside is a neighborhood with high vacancy rates and low housing costs, but its proximity to downtown has been attracting residents and investors in recent years. Last year, median sale price grew 30% to $141,000. Volume grew from $5.6 million to $9.5 million.

With a median sale price of $223,000 in 2023, Spades Park is more expensive than Riverside, but still seen as an ‘up-and-coming’ area. Median sale price grew by 65% between 2022 and 2023, while price per square foot increased by 35%. This created an additional sales volume of nearly $2 million.

Lockerbie Square was one of the city’s first neighborhoods to redevelop in the 1980s. In fact, though the neighborhood dates to the 19th century, the typical home sold last year was built in 2003.

Lockerbie Square is now a relatively expensive neighborhood, but this did not prevent strong growth in both price and sales last year. The median sale price in 2023 was $405,000, up 18% from 2022. Sales were up 26%, counter to overall market trends. This led volume to increase from $20.1 million to $27.3 million, an increase of 36%.

We have shown that, despite lower prices, older, dense, and walkable neighborhoods have proven themselves to be dynamic markets—strong price and sales growth amid a contracting market in 2023 made these neighborhoods leaders in volume growth.

However, when we try to directly measure the effect of walkability on price, we face the challenge that older homes have lower values and most walkable neighborhoods are older. To overcome this, we built a statistical model that measures the relationship between walkability and price while controlling for the age and size of a home.

A home in the most walkable neighborhood could be worth 27% more than the same home in an average neighborhood.

We find that buyers will pay a premium for walkability, especially in the most walkable neighborhoods. The relationship is not linear—prices are high for neighborhoods with very high and very low walkability.

To measure walkability, we used the Walkability Index from the U.S. Environmental Protection Agency. This measures walkability for census block groups, which are small areas about the size of a neighborhood. Three components contribute to walkability:

Half of the variation in price from one home to another can be attributed to differences in age, square footage, and walkability. For home sales in urbanized counties, each year of age subtracted $125 from the home price and each square foot added $108. Walkability was more complicated. Rather than affecting price in a straight line, walkability has a ‘quadratic’ relationship to price. Increasing from very low to moderate walkability will actually decrease home values—buyers will pay a premium for a rural area or subdivision with very large lots. Increasing from moderate to high walkability increases price exponentially—buyers will pay a premium for dense, very walkable neighborhoods, and the more walkable the neighborhood, the higher the value increase. In other words, implenting a single measure, like planning a grid street network or developing a mixed use neighborhood anchor, could add to home values. But adding an additional measure, like introducing a new transit line to the area, could add exponentially more to home values.

The walkability premium does not apply to all homes equally. For older and newer homes, more walkability leads to a higher sale price, but for homes built in the middle of the 20th century, it does not. This could reflect issues with the walkability index—living near many different types of businesses downtown makes it easy to walk, but living near a suburban shopping mall does not make it easy to walk due to infrastructure that the index does not measure.

Newly built homes actually benefit most (in terms of value) from walkable neighborhoods. Whether through infill in older urban neighborhoods or new, walkable suburban town centers, builders of new housing supply in walkable neighborhoods will benefit from this price premium.

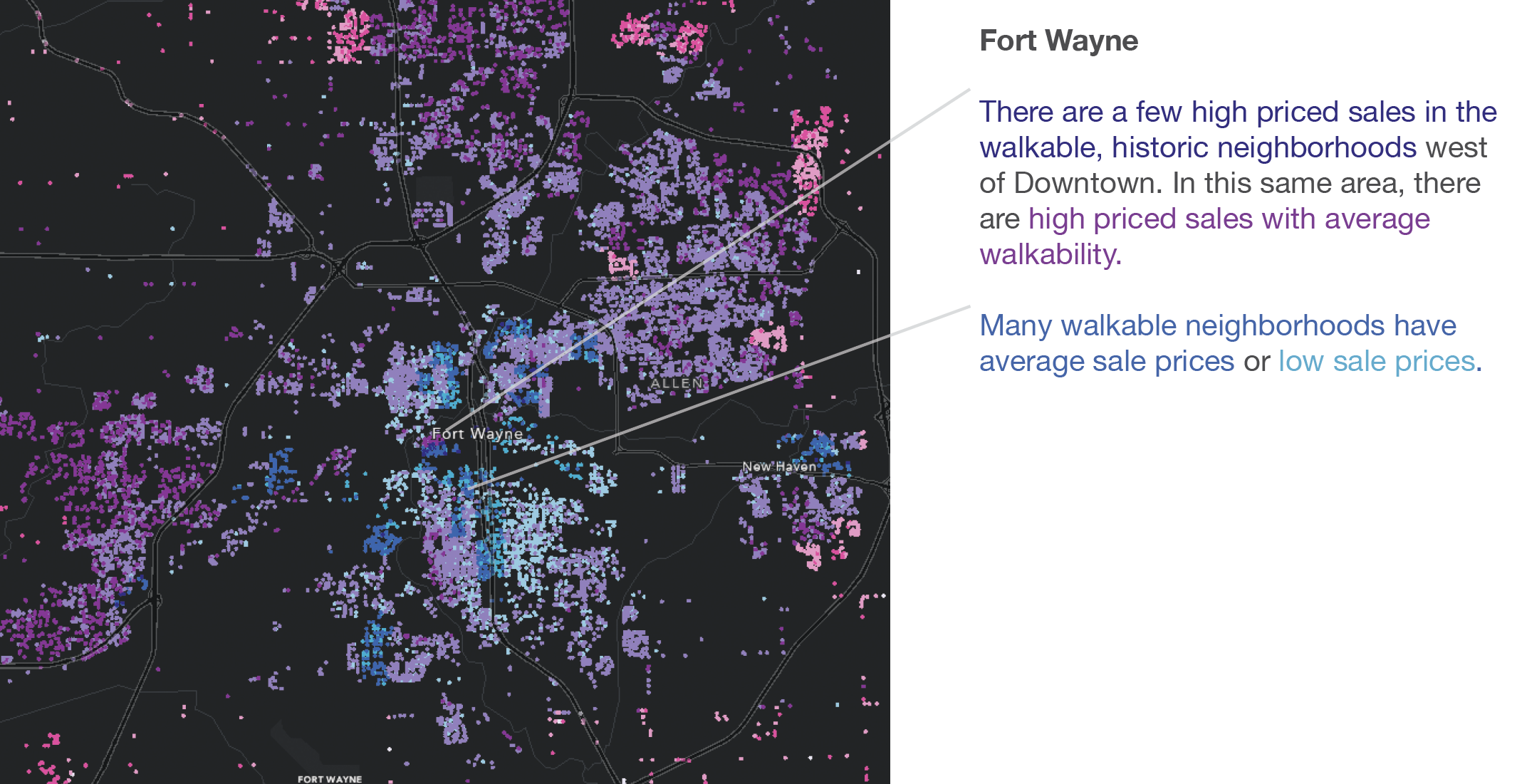

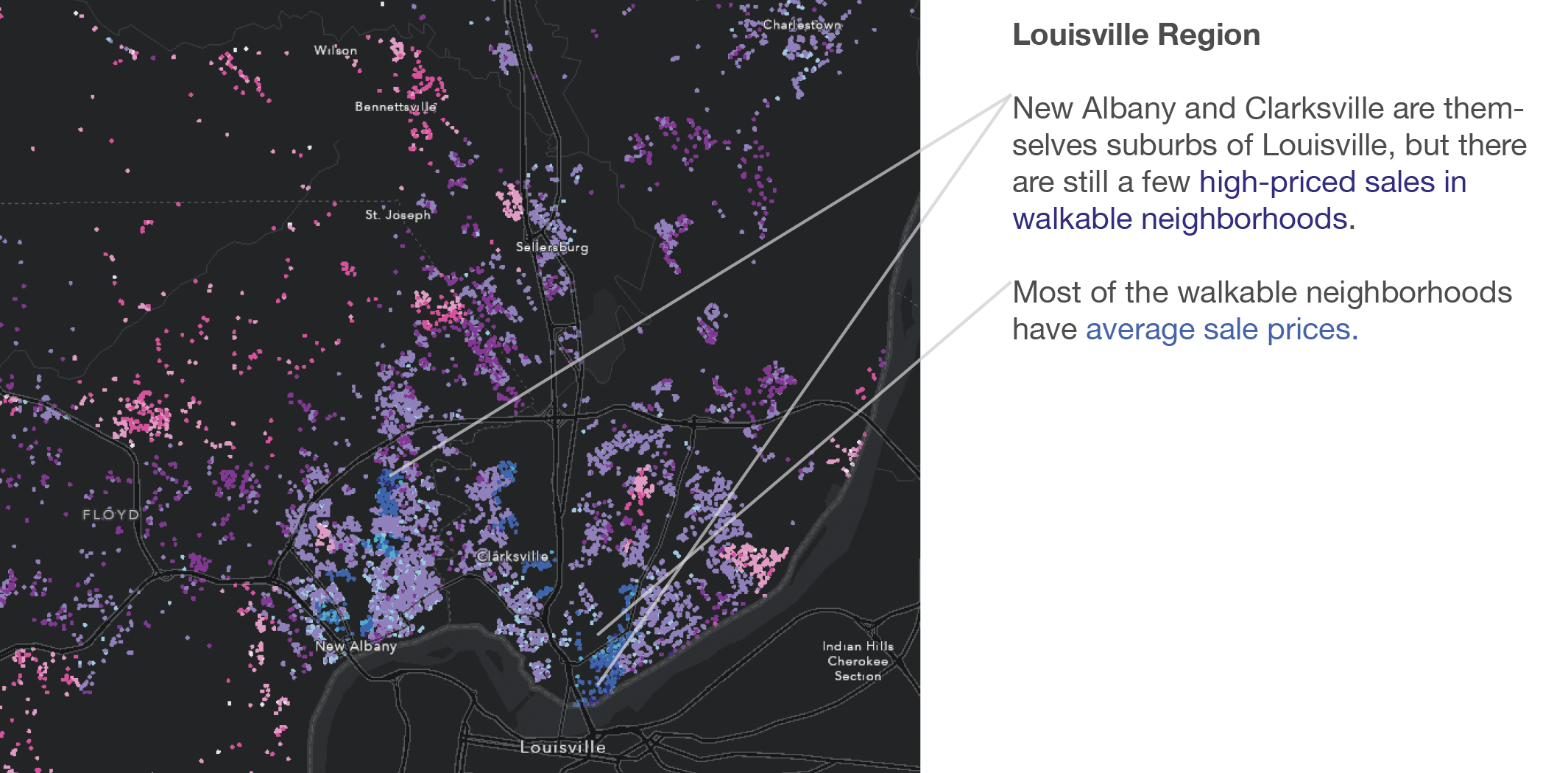

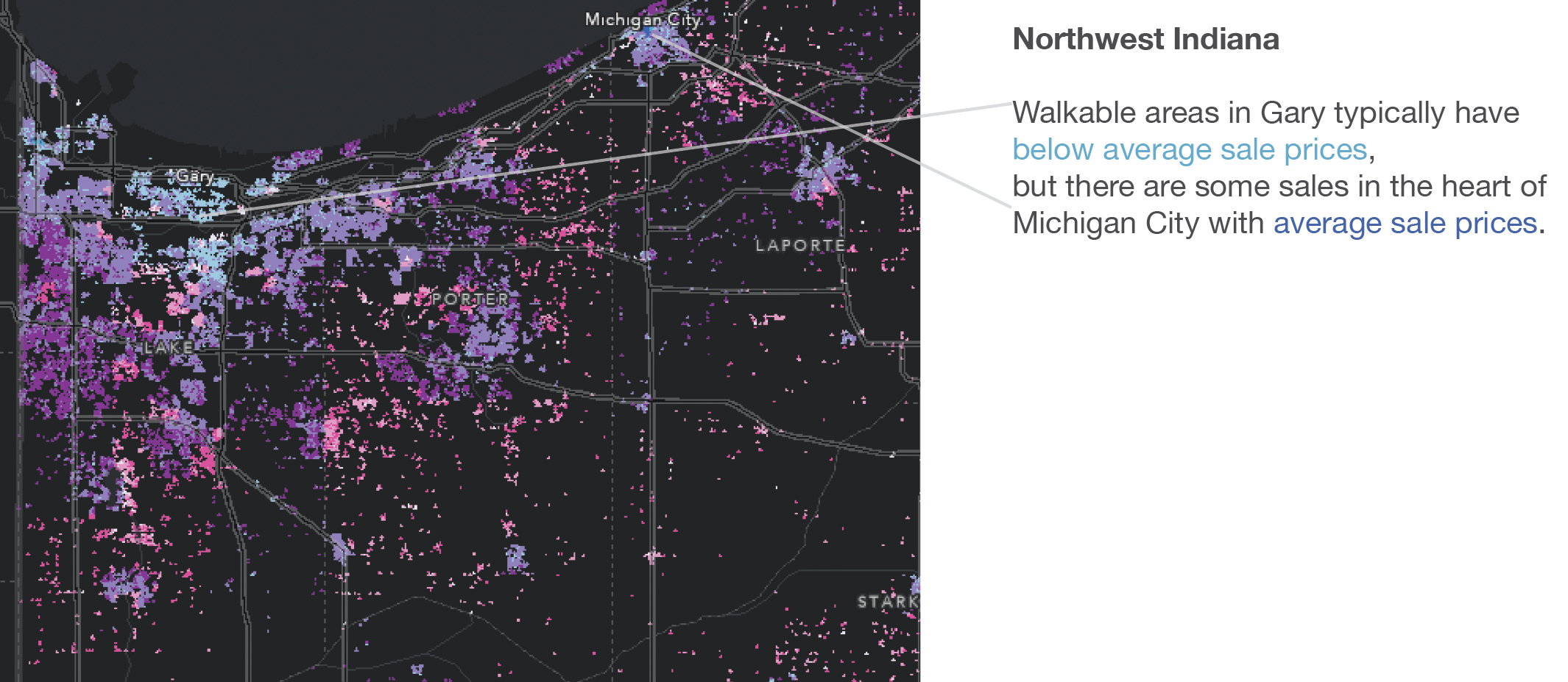

On average, urbanized counties as a whole had a positive relationship with walkability. But on a county-by-county basis, five counties had a positive relationship between walkability and price, while the other 14 urbanized counties did not.

While these 14 counties may not have consistently high home values in walkable neighborhoods, many still have dynamic city centers. The maps beginning on page 11 show walkable, center-city neighborhoods in Muncie, Fort Wayne, South Bend, and Evansville that all experienced growth in price, sales, or volume in 2023 while the rest of the market contracted. Often these neighborhoods begin with such low prices that, even after strong price growth, homes are more affordable than the county average.

The results of our model parellel MIBOR’s Consumer Preference Survey, where Marion and Hamilton counties showed the strongest preference for walkable neighborhoods.

The Consumer Preference Survey also reinforces the importance of walkability as an increasingly important issue for homebuyers. Between 2012 and 2022, the share of Central Indiana adults who thought the “number of shops or restaurants within walking distance of your home” increased by eight points, from 35% to 43%. The share who thought sidewalks were important increased by nine points, from 50% to 59%.

Though a majority think sidewalks are important in their community, only 43% are satisfied with their sidewalks. Walkability was important to 43% of adults, but only 29% were satisfied with their own community’s walkability. And while 35% thought public transit is important, only 21% are satisfied with transit in their community.

This represents an opportunity to build on the demand for walkable neighborhoods by investing in places that meet the desire of a significant share of homebuyers: neighborhoods with quality sidewalks, robust transit, and destinations within walking distance.

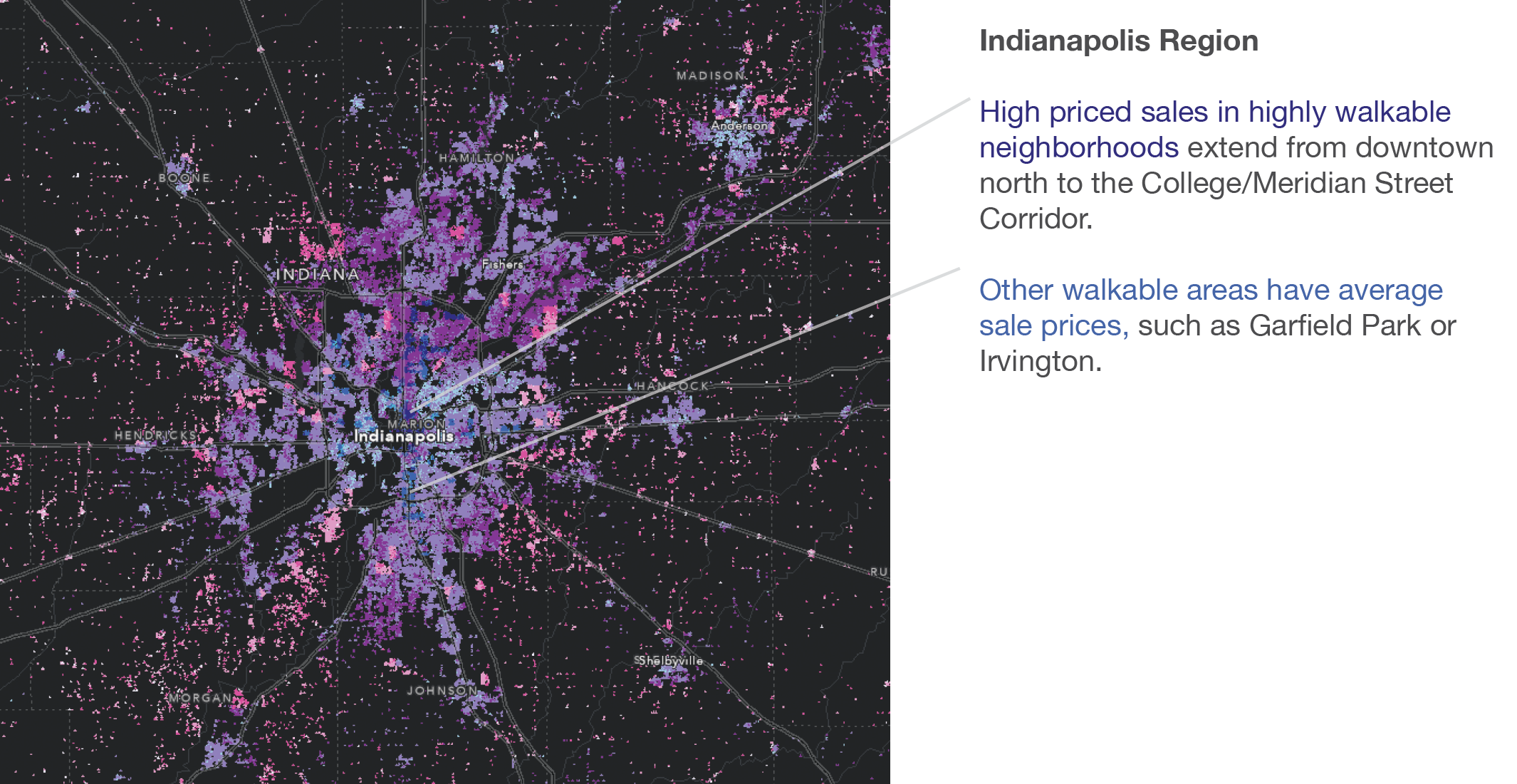

These maps visualize the relationship between price and walkability. Each dot represents a home sold between 2021 and 2023. Dark purple dots are high-priced sales (at least 50% higher than the county average) in highly walkable areas (at least a score of 15 from the EPA’s Walkability Index).

Zoom in on the map below to explore 60price and walkability in detail. Each dot represents a sale. Look for dark purple dots: these are sales in very walkable neighborhoods with above average prices. Open the legend using the button  in the top right corner.

in the top right corner.

This issue brief is only an initial exploration of housing supply and demand in walkable neighborhoods, which vary by community and are impacted by a variety of economic and population trends as well as broader quality of life and cost of living considerations.

We will close with a few concluding thoughts on the implications of this analysis and issues that may require additional study:

For real estate professionals, the ‘walkability premium’ signals business opportunities: Community preference surveys show that younger homebuyers are most drawn to walkable neighborhoods; they also place a higher importance on proximity to work (American Strategies, NAR).

While prices are rising quickly in many of the walkable, pre-war neighborhoods close to city centers, overall sale prices are still more affordable than much of the newer construction in less walkable areas further from downtowns. Brokers can guide buyers to options within their budgets in the convenient, connected areas that they prefer.

For local officials, the analysis provides more evidence that downtown redevelopment can drive residential demand, and that dense, walkable housing can also pay off in rising assessed values.

Core cities are often fiscally constrained; overlapping taxing units push property tax liabilities towards their constitutional caps, while the base is narrowed by a higher concentration of tax-exempt properties. Increased housing demand in urban neighborhoods adds needed revenue capacity. Local authorities should examine zoning, permitting and other regulatory policies that impact residential construction and renovation in these areas.

For policymakers and housing advocates, positive sales trends in these urban neighborhoods suggests in-fill, higher density and mixed-use development as viable strategies for filling Indiana’s housing gap consistent with market demand, especially considering the site acquisition and infrastructure costs associated with greenfield development projects.

Of course, Indiana REALTORS® support an “all of the above” approach to adding residential inventory across urban, suburban and rural communities, as supply challenges are widespread across the state – but pre-war neighborhoods should be recognized for their increasing relevance in today’s housing markets.